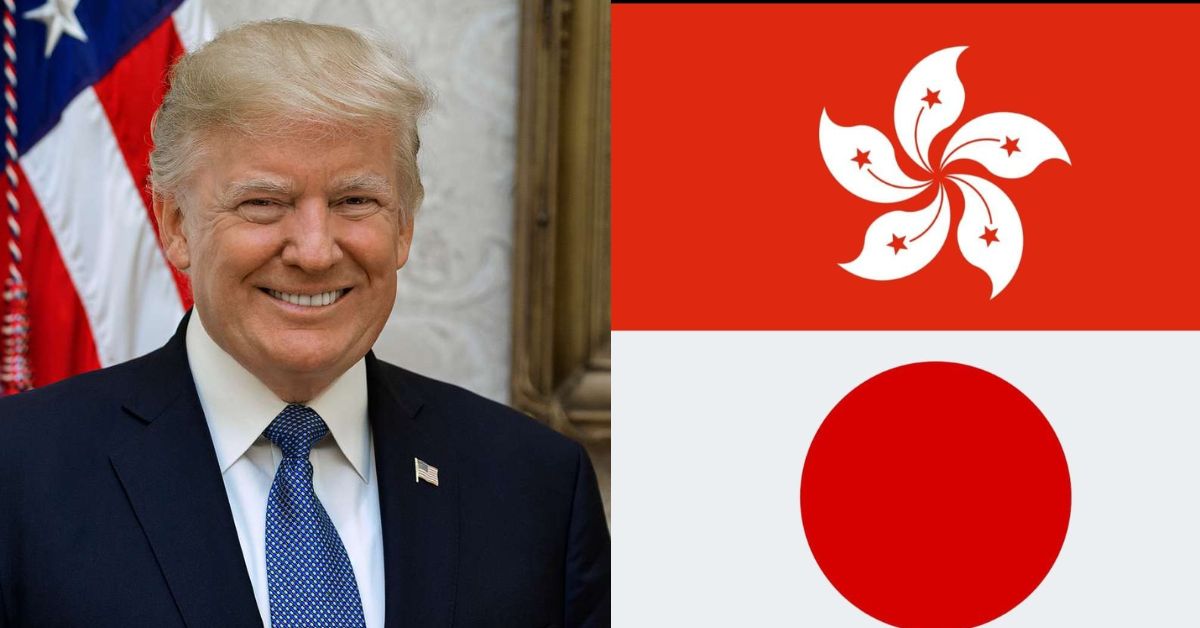

NEW YORK — American Bitcoin, a U.S.-based cryptocurrency mining company backed by Donald Trump Jr. and Eric Trump, is setting its sights on Asia to bolster its Bitcoin reserves, according to a report by the Financial Times on Saturday, August 16, 2025. The firm is exploring acquisitions of publicly listed companies in Japan and potentially Hong Kong, aiming to emulate the strategy of MicroStrategy, which holds over 628,946 BTC valued at approximately $73.8 billion. The move signals an ambitious push to establish a global crypto treasury platform amid a favorable U.S. regulatory climate.

The company, which rebranded from American Data Centers earlier this year, already holds 215 BTC as of June 10 and raised $200 million in June to expand its mining operations and Bitcoin stockpile. “We aim to build the strongest and most efficient Bitcoin accumulation platform in the world,” American Bitcoin stated, emphasizing operational efficiency and long-term shareholder value. While no binding commitments have been finalized, the firm is engaging investors to convert Asian acquisitions into regional Bitcoin treasury vehicles, tapping into Japan and Hong Kong’s robust retail crypto trading markets.

American Bitcoin’s strategy includes a planned Nasdaq listing in September through a reverse merger with Gryphon Digital Mining, with shareholders voting on the deal August 27. Unlike MicroStrategy, which relies on market purchases, American Bitcoin mines its own Bitcoin, leveraging a joint venture with Canadian miner Hut 8, which transferred equipment for a majority stake. This operational edge, combined with Asia’s growing demand for digital assets, positions the company to scale rapidly, according to industry analysts.

The Trump family’s broader crypto ventures add momentum. Trump Media & Technology Group plans to raise $2.5 billion for its own Bitcoin treasury, while World Liberty Financial, another Trump-linked entity, reported $57 million in earnings from its USD1 stablecoin. “The Asian market, particularly Hong Kong, is becoming a digital asset hub,” one analyst noted, highlighting the strategic fit of American Bitcoin’s expansion. As the firm navigates regulatory landscapes and investor talks, its moves could reshape the global Bitcoin treasury landscape, with the Trump name fueling both attention and scrutiny.

Source: Financial Times

Author

-

Marcus Hale is a finance professional turned content creator who specializes in personal finance, stock market analysis, crypto trends, and smart investing strategies. Known for simplifying complex financial concepts, Marcus helps readers make confident money decisions. Whether you’re budgeting, investing, or tracking global markets, Marcus delivers timely advice with clarity and authority.