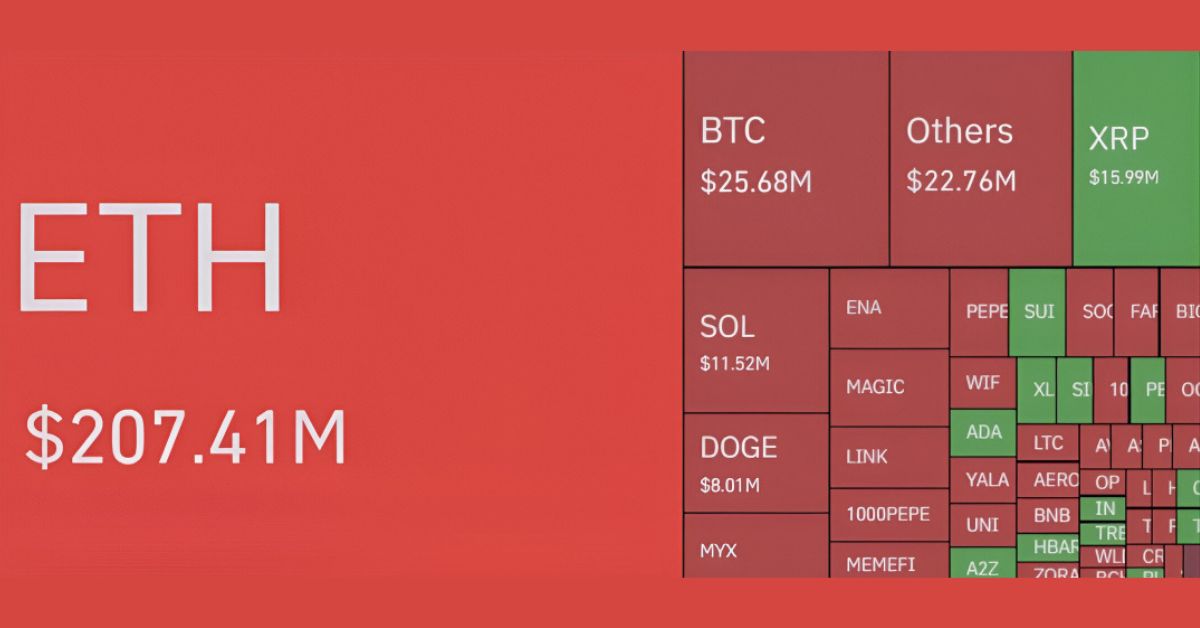

A massive wave of liquidations hit Ethereum short traders on August 8, 2025, with over $207 million in short positions wiped out in just 24 hours, according to posts on X by @greybtc.The surge came as Ethereum’s price reclaimed the $4,000 mark for the first time since December 2024, catching bearish traders off guard. The rally, which saw ETH climb to a high of $4,060 before settling at $4,015, marked a 4.6% gain in a single day, per CoinGlass data cited by Cointelegraph.

The liquidation frenzy was the largest for Ethereum shorts on Friday, accounting for roughly 53% of the $199.61 million in total crypto short liquidations across the market, as reported by Cointelegraph. In total, Ethereum saw $129.16 million in liquidations, with short sellers bearing the brunt. Eric Trump, son of President Donald Trump, took to X to comment on the market movement, saying, “It puts a smile on my face to see ETH shorts get smoked today. Stop betting against BTC and ETH – you will be run over,” as shared by @CryptoAaravX. The sentiment was echoed across X, with @DecodedMalek noting that 101,808 traders were affected, including a single $10.63 million ETH position liquidated on OKX.

Crypto trader Ash Crypto highlighted a critical price point, stating, “If ETH breaks $4,100, it could trigger a short squeeze which will send ETH to $4,400-$4,500 in just a few hours,” per Cointelegraph. The bullish momentum was fueled by growing institutional interest, with spot Ether ETFs recording $537 million in inflows over the past four trading days, according to Farside data cited by Bitnewsbot. Analyst Ted expressed unprecedented optimism, saying, “It’s never been this bullish in my opinion,” pointing to ETF demand and institutional adoption, per Cointelegraph.

Key details of the Ethereum liquidation event include:

- Massive Losses: $207 million in ETH short positions liquidated in 24 hours.

- Price Surge: ETH hit $4,060, up 4.6%, with $4,100 as a key resistance level.

- ETF Inflows: $537 million flowed into spot Ether ETFs over four days.

Analysts are eyeing lofty price targets, with trader Moustache predicting Ethereum could reach $10,000, while Fundstrat’s Tom Lee suggested a potential climb to $16,000, comparing the rally to Bitcoin’s 2017 surge, per Bitnewsbot. The liquidation event underscores Ethereum’s volatile yet bullish trajectory, driven by strong market sentiment and institutional backing, though traders are cautioned to remain vigilant given the market’s unpredictability.

Author

-

Marcus Hale is a finance professional turned content creator who specializes in personal finance, stock market analysis, crypto trends, and smart investing strategies. Known for simplifying complex financial concepts, Marcus helps readers make confident money decisions. Whether you’re budgeting, investing, or tracking global markets, Marcus delivers timely advice with clarity and authority.